$14 an hour 40 hours a week after taxes

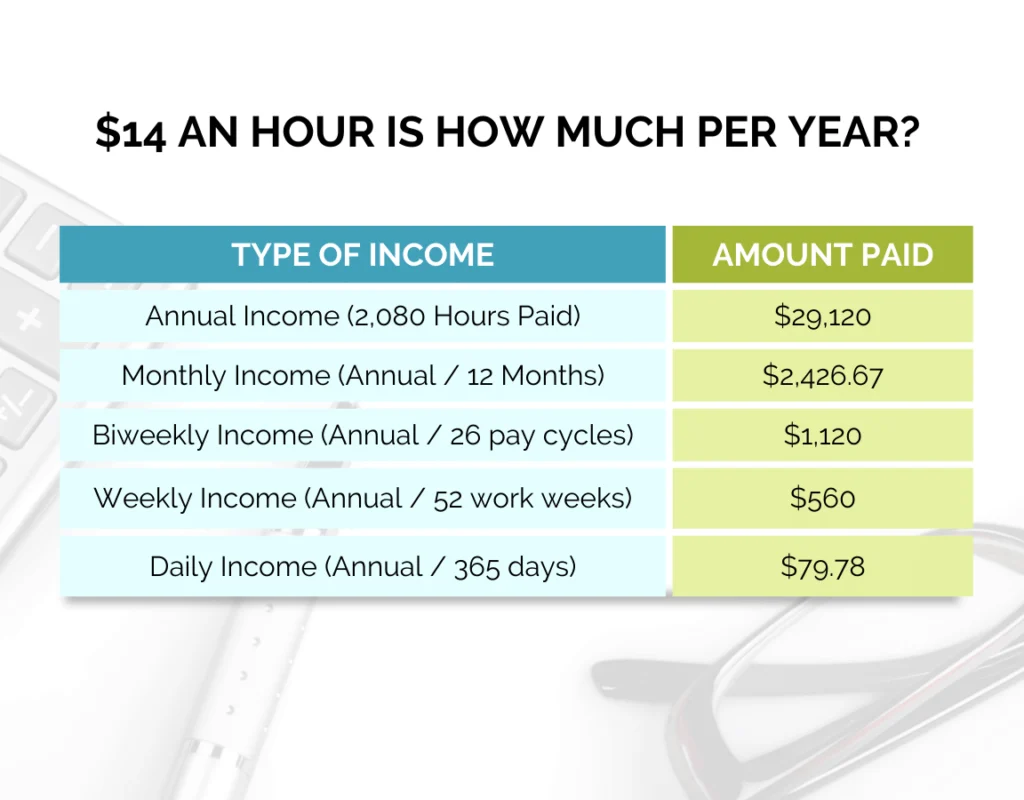

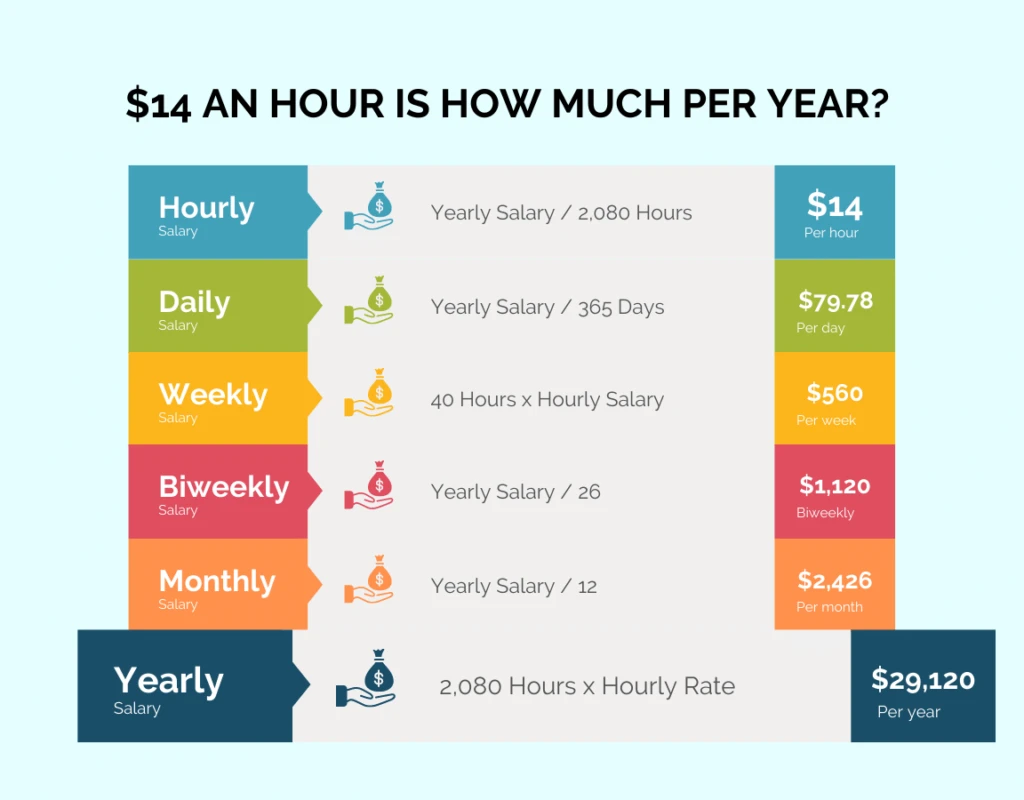

2080 hours 14hour 29120year. 1450 an hour is how much a a year without vacation time.

37 Things You Ll Regret When You Re Old

To calculate how much you make biweekly before taxes you would multiply 11 by 40 hours and 2 weeks.

. It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 14 hourly wage is about 28000 per year or 2333 a month. For example if you work 50 weeksyear and 40 hoursweek you will make 28500 dollars per year if you make 1425 per hour. 1450 an Hour is How Much a Year working full-time with unpaid vacation.

For more detailed instructions visit How to calculate your annual income from hourly wages How much is 14 dollars after taxes. How much would I make in a month. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 780 after taxes.

The tax that both employers and employees must pay is the Federal Insurance Contributions Act FICA tax. To calculate how much 14 an hour is per year we first calculate weekly pay by multiplying 14 by 40 hours per week and then we multiply the product by 52 weeks like this. 14 an hour 40 hours a week after taxes Primary Menu.

14 an hour 40 hours a week after taxes. With many in the United States negotiating for an hourly rate of 15 per hour its important to consider what that would be as an annual salary. 56000 52 weeks.

FICA has two parts. 40 Work weeks per year. If they are paid 12 an hour that comes to 288 per week.

Now you know that your gross income per year income before tax is 2912000 if you make 14 per. Social Security tax and Medicare tax. If the waitress receives 5 an hour in wages that comes.

1410 Work hours per week. But in this world nothing can be said to be certain except death and taxes. A worker who works a 85-hour lunch to dinner shift on weekend works 17 hours a week.

To determine a more accurate picture of your take-home hourly wage youll also need to consider holidays PTO. To calculate the total hours worked in a year multiply 40 weekly hours 8 hours a day x 5 days per week by 52 calendar weeks giving the value of 2080 total working hours. A typical salaried worker will work about 2000 hours every year.

12 To calculate how much 1410 an hour is per year we first calculate weekly pay by multiplying 1410 by 40 hours per week. 14 an hour 40 hours a week after taxes. Multiply 2080 by 14 and you will have your gross annual income.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 660 after taxes. In the United States it is common to takes 2 weeks of vacation per year and work 50 weeks. 2912000 per year.

At 40 hours a week 14 dollars an hour will be 29120 a year with only federal holidays off and 28000 if you take two weeks vacation. If you work full-time at 40 hours per week for 50 weeks in a year Assuming 2 weeks unpaid vacation time 1450 per hour annually would be a salary of 29000 per year before taxes. Our calculations are based on the following information but you can change the numbers further down on this page to make it better reflect your situation.

A worker who works the 8-hour graveyard shift 3 nights a week at the gas station is working a total of 24 hours. The taxes that you have to withhold from employees wages are. 40 hours 52 weeks 2080 hoursyear.

See where that hard-earned money goes - Federal Income Tax Social Security and other deductions. State disability insurance tax. 1450 is How Much a Year Working Part-Time 30 Hours a Week.

14 an hour 40 hours a week after taxes. There are a few different options that employers can take but generally employees must earn at least one hour of paid sick leave for every 30 hours worked. 40 Work weeks per year.

Wingstop lower east side. Hourly employees must be paid 15 times their regular hourly rate for any time worked beyond 40 hours in a week. 56000 per week.

If you work full-time 40 hours a week 52 weeks a year the gross salary would be 31200. The current annual per employee maximum is 434. Whats the total number of working hours in 2022.

14 40 hours. Overtime can be entered separately. Enter the number of hours.

The amount of money you are paid each hour before tax. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. 52 Income Tax Rate.

Full Time Minimum Wage Workers Can T Afford The Rent On A 2 Bedroom Apartment Anywhere In The Usa Boing Boing Rent Map Apartment Cost

Avanti Gross Salary Calculator

2013 Small Business Tax Infographic Business Tax Small Business Tax Small Business Accounting

Avanti Gross Salary Calculator

Tommy Hilfiger Monogram Crossbody Bag

14 An Hour Is How Much A Year How To Fire

Oris Artelier Calibre 113 11377384031mb On Sale Oris Watches Watches For Men Watches

Hourly Salary To Weekly Paycheck Conversion Calculator

Repost Sunnysideshines With Get Repost Sunnyside Restaurant Week Is Just A Week Away From Saturday September 23 T Restaurant Week Lunch Specials Eat Local

If You Own Closed End Funds Cefs I Have Great News Equity Cefs Are Doing Exactly What We Want Them To Crushing The Market While Tax Free Bonds Fund Equity

Cassandra Gets Fit Push Those Limits Pushing Yourself Quotes Be Yourself Quotes Fitness Quotes

14 An Hour Is How Much A Year How To Fire

The Map Of Mass Shootings Vivid Maps

Style Swiss Yellow Gold Automatic Champagne Dial Men S Watch

Disney World Tickets And 2022 Ticket Prices Yourfirstvisit Net